ChatGPT & NLP: Revolutionizing Financial Communication

Embracing the Next Generation of Financial Interactions with ChatGPT, NLP, GenAI and LLMs.

Natural Language Processing (NLP) is nothing new. In fact, the first usage was during World War II.

The field of natural language processing began in the 1940s, after World War II. At this time, people recognized the importance of translation from one language to another and hoped to create a machine that could do this sort of translation automatically. Source: Standford.

In Finance, NLP found its sun rises much later. Financial institutions, long seen as institutions of old-fashioned, traditionalism, and not innovative, are undergoing a significant transformation. At the heart of this transformation lies a powerful duo: ChatGPT and Natural Language Processing (NLP).

But how are these advanced technologies reshaping the financial communication landscape? Let’s dive in.

A Brief Primer: Understanding ChatGPT and NLP

NLP is the intersection of AI and linguistics, enabling machines to understand, interpret, and generate human language. This capacity to interact with language opens up new horizons in computing and has profound implications in finance.

ChatGPT is a state-of-the-art model based on the Transformer architecture. It includes multiple layers of attention mechanisms, enabling it to “pay attention” to different parts of the input when producing an output.

For those under my readers interested in the technical part of Transformers, I highly recommend the article “Understanding Transformer Neural Network Model in Deep Learning and NLP”.

The core of ChatGPT is its ability to convert language into numerical forms called embeddings. These embeddings are processed through multiple model layers, each adding complexity and understanding. The final layer deciphers the numerical form back into human language, providing coherent and contextually accurate responses.

Training ChatGPT involves exposing it to extensive text data. A method called “unsupervised learning” builds an understanding of syntax, semantics, and even nuances of human language. This grounding enables it to converse, compose, and engage with human users.

What sets ChatGPT apart is its “few-shot” learning capability, meaning it can perform tasks with minimal specific instructions or examples. This quality makes it highly adaptable and capable of understanding complex financial scenarios, regulations, and terms.

Here are two other fascinating sources for my technical audience:

The New Face of Financial Communication

The integration of ChatGPT and NLP in Finance is revolutionary for financial communication. These technologies collectively dismantle longstanding barriers, amplify operational efficiency, and pave the way for exceptional personalized interaction in finance.

Imagine a scenario where each user’s experience is uniquely molded to suit their profile, reflecting their investment history and personal preferences. This is the promise of ChatGPT. By tailoring information delivery in this manner, there’s a noticeable uptick in user engagement, driving satisfaction and loyalty.

Imagine a scenario where each user’s interaction with a bank is responded to through an AI-powered either by an NLP chatbot or an LLM chatbot such as ChatGPT. This is the promise of GenAI (Generative AI)—tailored information delivery for every customer, not just those with cash.

Imagine a scenario where each employee of a financial institute can retrieve the correct information they need without searching for hours or days—a promise of LLM.

Other transformative use cases are enabled through ChatGPT in the role of customer support. The diverse range of financial queries, from essential to highly complex, often tests traditional support systems. ChatGPT seamlessly addresses this by automating responses to the more typical questions. This minimizes customer wait times and allows human agents to channel their expertise into resolving more complex queries.

Moreover, the finance sector, notorious for its jargon and complex terminologies, often feels inaccessible to the average person. ChatGPT acts as a bridge, translating this complex financial language into more relatable terms, thus democratizing information access. Such efforts promise a more inclusive financial future where a broader population can actively participate.

Additionally, the financial world is ever-evolving, with new developments occurring quickly. ChatGPT can search through many global financial news, tweets, blogs, and market data to extract real-time insights. With these insights, traders, investors, and financial advisors are better positioned to make informed decisions.

On a global scale, the linguistic versatility of ChatGPT cannot be understated. Its prowess in multiple languages enables financial institutions to transcend geographical and cultural confines, allowing for a more extensive, diverse clientele base.

However, as with all AI-driven communication tools, ChatGPT’s integration comes with responsibilities. Upholding transparency, ensuring unbiased responses, compliance with global regulations, and prioritizing user privacy are non-negotiables in establishing and maintaining trust.

Automated Customer Service: Gone are the days of waiting endlessly on calls to get your credit card details sorted or understand a new investment plan. With ChatGPT-driven bots, financial institutions can offer real-time, accurate, and personalized customer support. The best part? They’re available 24/7, ensuring global clientele can receive assistance irrespective of time zones.

Comprehensible Financial Summaries: Financial jargon can be daunting, even for the initiated. NLP models can sift through dense financial reports, extracting key points and presenting them in lucid, understandable language. For an investor, this could mean the difference between making an informed decision and getting lost in a sea of numbers.

Sentiment Analysis for Market Trends: The financial market is a living, breathing entity influenced by global events, political shifts, and public sentiment. By analyzing vast amounts of data from news sources, blogs, and social media, NLP tools can gauge market sentiments, often predicting trends with impressive accuracy.

The integration of ChatGPT and NLP is reshaping financial communication by breaking down barriers, adding efficiency, and fostering a more personalized interaction.

Personalized Experience: Unlike traditional systems, ChatGPT can provide tailored information based on individual profiles, investment history, or personal preferences. This personalization deepens engagement, enhancing customer satisfaction and loyalty.

Efficiency in Customer Support: Financial queries vary widely in complexity. ChatGPT frees human agents to tackle more intricate issues by automating responses to common questions, reducing wait times, and enhancing overall efficiency.

Bridging the Knowledge Gap: By translating complex financial terms and data into everyday language, ChatGPT makes finance more accessible to everyone. This democratization of information fosters a more inclusive financial landscape, encouraging broader participation.

Real-time Market Insights: ChatGPT can sift through global financial news, tweets, blogs, and market data, offering real-time insights. These insights can guide traders, investors, and financial advisors, leading to more informed decisions.

Multilingual Support: The ability to converse in multiple languages extends financial institutions’ reach, allowing them to engage with diverse clientele across geographical and cultural boundaries

Ethical Considerations: With AI-driven communication, transparency, and ethical considerations become crucial. Ensuring that the responses are unbiased, compliant with regulations, and respecting user privacy is vital to maintaining trust.

Deep Dive: How ChatGPT Stands Out

The attraction of ChatGPT isn’t just in its functionality but in the way of its design and the vast spectrum of its capabilities. One of its standout features is the attention mechanism. By honing its focus on specific portions of text, ChatGPT can weave connections, providing users with coherent and extended dialogues that resonate with context and clarity.

Its scalable design is another feather in its cap, allowing it to adapt across different operational magnitudes. Whether it’s simplifying interactions on chatbots or driving intricate analytical tools in finance, ChatGPT is versatile.

Furthermore, its applications aren’t restricted to finance. Fields like law, healthcare, and education can harness its potential, reinforcing its robustness, especially when encountering financial inquiries intertwined with legal or regulatory intricacies.

ChatGPT, despite its extensive pre-training, offers customization avenues. Financial institutions can fine-tune it to resonate with specific domains or products, ensuring its relevance and accuracy.

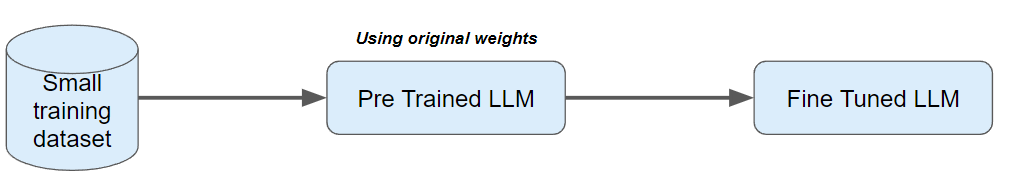

We recognize two knowledge transfer methods for LLM models: “Fine-tuning” and “Context-Based Learning.” Both methods are essential.

Fine-tuning an LLM

Fine-tuning large language models for specific tasks or domains as a core step means we adapt the model’s learned representations to the target task by training it on particular data. This training boosts the model’s performance and gives it task-specific skills.

This involves using specific data, like “Answer/Question” or “User/Agent” interactions, to tailor the LLM to individual needs.

Fine-tuning doesn’t rival original training. Given the LLM’s foundational training on vast data, it’s hard to compete.

The knowledge you infuse is task-specific — perhaps tailored for customer interactions — but transferring entirely new knowledge is challenging.

This brings us to our following method of knowledge transfer: “contextual learning”.

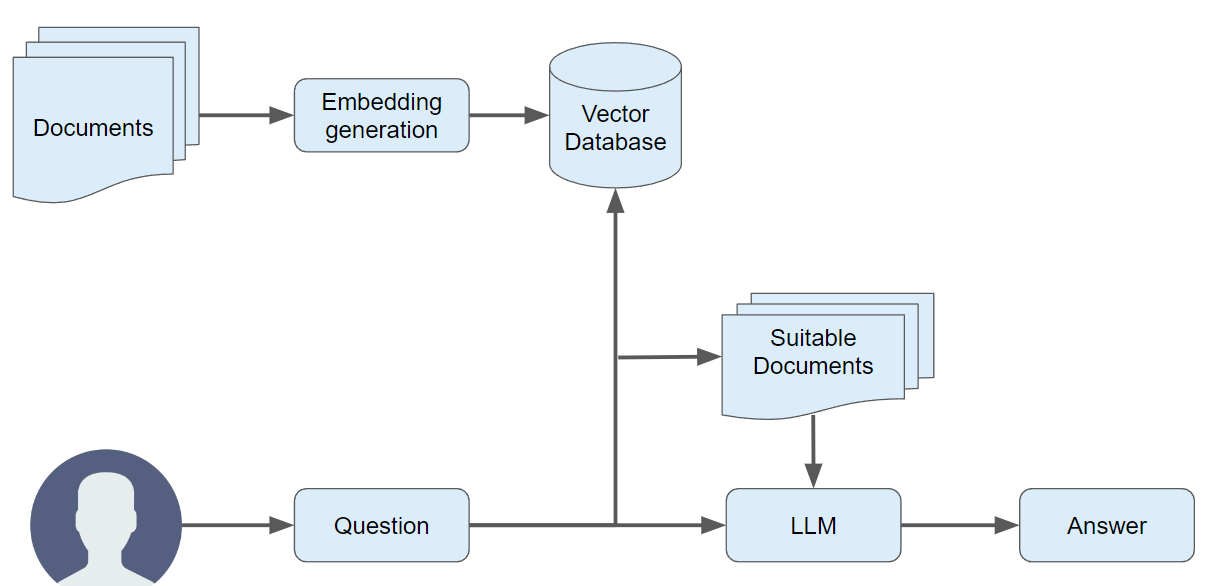

Context-Based Learning in LLM

In Context-based learning, the LLM responds to questions using the information provided in the prompt.

It’s important to know that with context-based learning, the model itself doesn’t change; instead, you’re just giving it extra knowledge to answer better.

The arising questions are:

How do we source the correct information for a user’s question to include in the LLM’s prompt?

Why do we still have to send this to the LLM? Why not feed the knowledge directly as “context” to the user?

Q1: To source the correct information, a vector database is essential for similarity searches.

Take a user’s question, “What is a Llama 2?” The algorithm scans your knowledge in the vector database and pulls content related to the prompt (“User’s question”). This becomes the necessary “context” for the LLM.

Q2: Would you rather sift through hundreds of words to find an answer or let the LLM condense large chunks of text into a concise response?

This highlights the ongoing need for LLMs. If users want sources, include them in the response for deeper exploration.

Context-based learning is crucial when using new knowledge the LLM doesn’t know or when we need more accurate responses.

What is the difference?

We use fine-tuning to retrain LLMs on smaller, task-specific datasets, adjusting their weights to specialize in particular domains. For example, training a generic model on medical texts tailors it for medical queries.

On the other hand, in context-based learning, we guide the model’s responses by feeding it specific context during a query without changing its internal weights.

So, while fine-tuning customizes the model for specific tasks, context-based learning steers the existing model’s output with the given context.

Integrating with Existing Systems

Melding ChatGPT into the existing infrastructure of financial systems demands a meticulous blend of technical prowess and strategic foresight. The journey starts by crystalizing organizational objectives, whether enhanced customer service, decision-making support, or simplifying financial narratives.

The technical facet of this integration pivots around aligning ChatGPT with current data setups, fortifying security measures, and ensuring a seamless user interface. This work often involves an interdisciplinary synergy among AI enthusiasts, IT professionals, and financial experts.

Post-integration, the task doesn’t end. A vigilant monitoring regimen is crucial to ensure efficient and ethical operations. Routine audits, updates, and feedback mechanisms ensure that ChatGPT remains aligned with the dynamic world of finance.

Given the sensitive nature of financial data, security and privacy are paramount. Ensuring ChatGPT’s alignment with data protection regulations and fortifying it with encryption and access controls becomes critical.

Finally, it’s essential to gauge the impact. Organizations can glean insights into areas of success and potential improvement avenues by evaluating metrics like user engagement, operational efficiency, and compliance post-integration.

ChatGPT and other advanced NLP models don’t operate in isolation. Their real power is unlocked when integrated with existing financial systems and a human in the loop:

Data Analysis Collaboration: Institutions often rely on an overload of tools for data analysis. Integrating ChatGPT can add a layer of interpretative intelligence, translating raw data into actionable insights in natural language.

Real-time Feedback: For financial platforms offering trading or investment options, ChatGPT can provide real-time feedback to users, guiding their decisions with timely information and analysis.

Challenges in the Financial Sector

Delving into the integration of advanced NLP models like ChatGPT within the financial landscape is nothing short of a thrilling endeavor. Yet, this venture, promising as it may seem, has obstacles. The essence of finance, characterized by its intricate systems and consequential operations, demands harmony between innovation and prudence.

The multifaceted language of finance presents the first challenge. Rich with specific terminologies and sophisticated models, ensuring an AI system like ChatGPT consistently deciphers and accurately relays this complexity is paramount. The stakes are high; even minor misinterpretations or oversimplifications can have severe financial implications.

Security is another prime concern. The sensitivity surrounding financial data is unparalleled. A single breach or unauthorized access could lead to explosive outcomes in monetary terms and reputational damage. This underscores the need for ChatGPT to function within a fortress of security, especially when addressing user queries.

Navigating the maze of global financial regulations is another daunting task. The dynamic nature of these laws means that ensuring ChatGPT’s advice remains locked with them is an ongoing challenge. Falling afoul of these can invite not just legal sanctions but can also erode the hard-earned trust of clients.

Then there’s the specter of bias. All AI models, no matter how advanced, risk reflecting the biases present in their training data. In the financial world, even a hint of biased advice can trigger accusations of favoritism or discriminatory practices, leading to significant repercussions.

Lastly, while beneficial, the symbiosis between organizations and ChatGPT poses a risk. Over-dependency on this technology could be perilous. Any technical glitches or misinformation could send ripples across financial operations, underscoring the need for balanced reliance.

Data Sensitivity: Financial data is both sensitive and confidential. Ensuring that ChatGPT and other NLP models respect privacy boundaries without compromising data integrity is paramount.

Misinterpretations: No model, regardless of its sophistication, is foolproof, especially ChatGPT - it can tend to hallucinate! There’s always the risk of misinterpretations, especially in areas as nuanced as finance. Regular updates, rigorous testing, and domain-specific training can help, but human oversight remains essential.

Over-reliance: While ChatGPT is a powerful tool, complete reliance on it can be detrimental. It should complement, not replace, human expertise.

Looking Ahead: The Future of ChatGPT in Finance

Envisioning the future liaison of ChatGPT with finance paints a picture brimming with innovation, streamlining, and enhanced client engagement. ChatGPT’s evolution into a hyper-personalized financial advisor is a notable transformation on the horizon. This iteration will tailor financial strategies and insights to individual fiscal health, aspirations, and risk thresholds, democratizing financial planning.

Further integration is expected to result in a seamless financial ecosystem. ChatGPT will interact harmoniously with various financial tools, databases, and platforms within this evolved landscape, offering a unified and streamlined user experience.

The ethical dimension of AI, already a topic of genuine discussion, will become even more pronounced; look forward to the EU AI Act. Future versions of ChatGPT will be armored with reinforced safeguards against biases. These iterations will champion ethical AI principles, ensuring the delivery of balanced and impartial financial insights.

Adaptability will be another cornerstone. The financial domain is ever-evolving, and ChatGPT, in its future avatars, will be designed to be agile. Learning from emerging data and trends will ensure its offerings remain contemporary and pertinent.

Yet, the most promising vision of the future is one where ChatGPT and financial professionals coalesce. Instead of a replacement, ChatGPT will emerge as a collaborative partner. By taking on data-heavy tasks, it will empower human experts to leverage its insights, blending the computational prowess of AI with the nuanced judgment of humans.

In wrapping up this contemplation of the future, the developing collaboration between ChatGPT and the financial world is bursting with potential. The journey, while fraught with challenges, is awash with opportunities. The key to unlocking its promise lies in balancing technological advancements with ethical considerations, stringent security, and the irreplaceable human touch.

As we peer into the financial sector’s horizon, the role of ChatGPT and NLP seems poised to expand:

Personalized Financial Assistance: Envision a world where each individual has a personal financial assistant, offering advice tailored to personal goals, risks, and preferences.

Global Financial Literacy: NLP models can break down language barriers, offering insights and guidance in multiple languages and promoting global financial literacy.

Seamless Cross-platform Integration: As people increasingly manage their finances across multiple platforms, ChatGPT can be the consistent guiding voice, ensuring users can always access informed advice.

The fusion of ChatGPT and NLP with finance signifies more than just technological progress; it represents a paradigm shift in how we understand, interact with and navigate the financial universe. As these tools become more ingrained in our financial journeys, one thing becomes clear: the future of finance is not just about numbers and data. It’s about communication, understanding, and making the complex world of money accessible to all.